Tesco’s share of grocery is down a point to 28.7%[1], its lowest point since Oct 07 and is now calling ‘cash not % margin (will) define our success’[2]. Sainsbury’s growth may have stalled and we have Goldman Sachs pointing to ‘the weakest balance sheet of the UK grocers and a poor track record of cash generation’[3]. Asda, though growing is still losing share and Morrison’s is warning of halved profits this year[4]. Meanwhile polarisation bears its fruit for Waitrose and the discounters as both ends of the market grow share.

What does this mean for grocery suppliers? The simple and obvious conclusion is that in the short term there will be yet more aggressive pressure for reduced prices and matching the discounters on any and every dimension. In other words the retailers will fall back on their usual strategy of inviting their suppliers to join in taking responsibility for their trading shortfalls – pushing suppliers to make up the underlying cost differentials that the mainstream retailers have built up compared to their discounter rivals and which they will now require a systemic and seismic shift to address.

This fundamental shift from a high cost/high gross margin business to a more balanced, controlled fixed cost/lower gross margin operation will not be a quick or easy journey and will create prolonged pressure on suppliers as the retailers work their way through this issue.

So what are the implications for grocery suppliers through this period of turbulence – apart from short term price pressure?

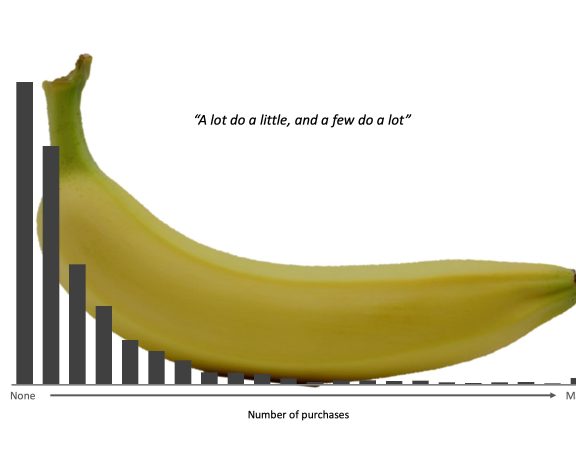

We believe it will peel back the shell of those that are stretched or stretching to make their numbers. Margins almost always fall on the altar of volume and while cost reduction helps stay competitive, it too ultimately ends up being traded away. The prizes will go to those who are led by real value (ie creating a genuine surplus of consumer benefits over price, not just low price); those who play for the longer term and so can afford not to fly close to the sun in the short term; and critically those who have built up robust and coherent trading and brand strategies which give them the ability to keep the word ‘no’ in their lexicon whilst adding a “but we might be able to” so correspondingly building options and alternatives to the next deep cut deal.

To deliver this effectively means a coherent trading strategy that is based on customer value as a route to market, the value of product and brand and the corresponding matrix of what is sold where at what price. Increasingly, successful brands will need to choose where they wish to be sold and where they may be prepared to sacrifice presence and volume in the short term if the cost of retaining that business becomes too onerous.

These issues will require careful and considered analysis at board level based on robust data – the trading strategy will increasingly become too important to be left just to the sales function.

If you are led by genuine value; if you have a carefully prioritised and specific set of pro-active trading and brand strategies; and your whole business gets it, keep going. If you would like to talk to us about it, if only to talk through some of the options, please get in touch for a no-commitment discussion – this is one of our special subjects, as they say on Mastermind.